Real estate investment trusts (REITs) can be effective ways to target a large and growing passive income over time.

Like any dividend share, the levels of income they pay are linked to the amount of earnings generated. However, REIT obligations state they must pay a minimum of 90% of annual profits in dividends in exchange for tax breaks. So investors often enjoy better income visibility with these assets.

Here are two top investment trusts that have grabbed my attention today. As well as offering that security, they also have the sort of dividend yields that suggest above-average passive income over the near term. So I feel they’re worth a closer look.

Should you invest £1,000 in Primary Health Properties right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Primary Health Properties made the list?

| Trust | Forward dividend yield |

|---|---|

| Schroder European Real Estate Investment Trust (LSE:SERE) | 7.5% |

| Primary Health Properties (LSE:PHP) | 7% |

Dividends are never, ever guaranteed. But if broker forecasts prove accurate, a £15,000 lump sum investment spread across these stocks will deliver a £1,088 second income just for their current financial years.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Euro star

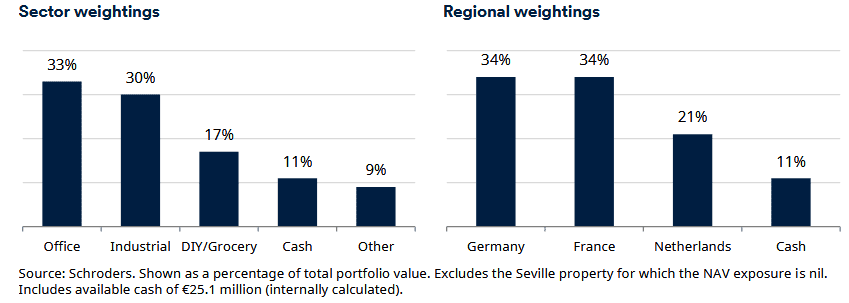

Though its 15 different assets, the Schroder European Real Estate Investment Trust invests in what it deems ‘winning cities’ across France, Germany and The Netherlands. These are locations that have significant scope for long-term growth.

While it’s focused on commercial assets, the trust spreads its exposure across multiple industries including retail and offices. This geographical and sector diversification helps it navigate weakness in particular areas and deliver a stable return over time:

Higher interest rates have been a problem across the REIT complex in recent years. And this Schroders trust could experience more stress than UK peers if the US and EU engage in a bloody tariff war.

However, lower inflation in the eurozone compared with Britain suggests the threat here could be less severe. Indeed, news last week that German consumer price inflation (CPI) fell to 2.1% in May — fractionally above the ECB’s target — is an encouraging sign.

At 66.8p per share, the Schroder European Real Estate Investment Trust trades at a 31.5% discount to its net asset value (NAV) per share. I think it demands serious attention at this price.

A ‘safe’ selection

To my mind, Primary Health Properties is one of the most secure passive income shares to consider today. It’s why I hold it in my Stocks and Shares ISA.

As the name implies, it focuses on the primary healthcare sector and operates 516 GP surgeries and other medical centres in the UK and Ireland. This isn’t just a rock-solid sector that’s immune to economic conditions, it’s one with substantial growth potential as governments act to divert patients from crammed hospitals to get treatment elsewhere.

Another reason I like Primary Health Properties is the majority (89%) of its rental income is bankrolled either directly or indirectly by government bodies. This provides earnings with another layer of security.

As I say, REITs like this are vulnerable to unfavourable interest rate rises. This particular one could also come under pressure if UK health policy changes.

But I hope these dangers are reflected in its low valuation. At 100p per share, the trust deals on a sub-1 price-to-book (P/B) ratio of 0.9.